Narre Warren shoppers have welcomed the changes to the stage three tax cuts as the issue looms as a potential hot button issue at the next election.

Labor MP Julian Hill, who represents the Bruce electorate, has naturally supported his party’s stance.

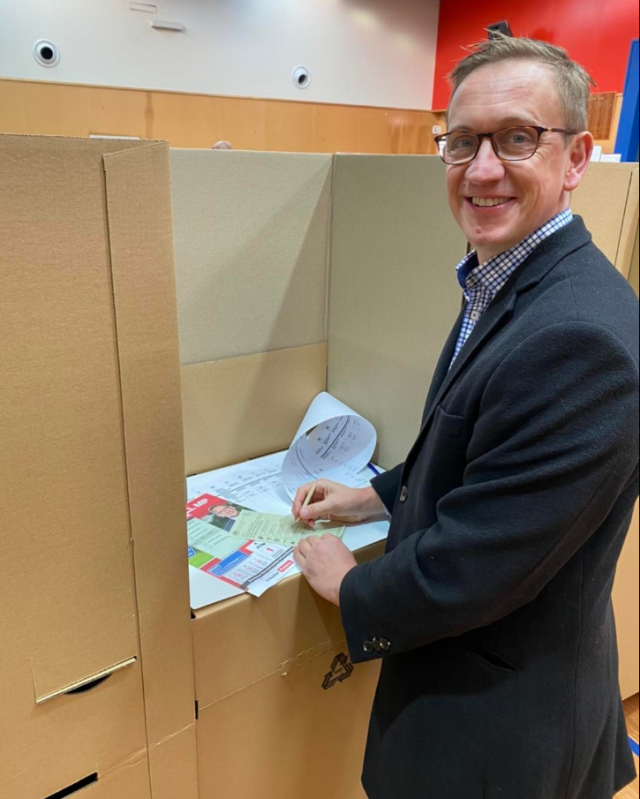

While the Opposition says it won’t stand in the way of the changes, La Trobe MP Jason Wood slammed the Prime Minister for going back on his word of not touching the stage three tax cuts.

However, the Liberal MP said “the Coalition affirms its commitment to achieving lower, simpler and fairer taxes, exemplified by our support for reducing the 19 cent tax rate to 16 cents”.

The changes, announced on 25 January by the Federal Government, will see low-income earners receive a larger tax cut than originally proposed.

According to the Treasury Department, 13.6 million Australians are to benefit from the redesigned stage three tax cuts, as compared to its previous model which catered to only 10.8 million taxpayers.

Effective on 1 July this year, the tax brackets for lower to middle income earners will be changing, with individuals earning $18,000 to $45,000 to have their tax rate reduced from 19 per cent to 16 per cent.

Likewise, the next tax bracket of those earning anywhere through $45,001 to $135,000 will have their tax rate change from 32.5 per cent to 30 per cent.

Essentially, more money in residents’ pockets allows for a little bit more breathing room, with local shoppers at Fountain Gate Westfield sitting on the fence between spending more or saving more.

One shopper said that the changes will “allow me to be better with my money.”

“Getting taxed makes me feel like ‘oh I can do whatever with my money since I’m not even earning that much’.”

“But since I’m a uni student it would help a lot with organising what I need to pay for my studies and so on,” the shopper said.

Other sentiments juggled between saving and spending, with one lady saying that “everything is so expensive at the moment”.

“I think I’ll be spending and saving, but we’re always spending now and we’re not saving anything,” she said.

The higher brackets have also changed, with those earning $135,001 to $190,000 being taxed at 37 per cent and anyone earning over $190,000 being taxed at 45 per cent.

Bruce electorate MP Julian Hill recently released a statement saying that Labor’s tax cuts “will provide a real cost-of-living relief to all 13.6 million Australian taxpayers without adding to inflationary pressures”.

“In Bruce, the average tax cut will be about $1335 each year, and 89 per cent of taxpayers will receive a larger tax cut under Labor’s plan than under Scott Morrison’s,” MP Hill said.

Legislated in 2018, the Treasury’s reasoning for the changes is revolved around the original stage three purposes, which did not cater to the economic impacts of the Covid-19 pandemic and other international conflicts.

Prior to these events, further statistics from the Treasury detailed that the Australian economy was meant to be supported by strong global growth, with inflation and interest rates expected to be low.

However, since these predictions hadn’t gone through the original intended effects, the government proposed changes to the stage three tax cuts. “Of course tax cuts alone will not fix the cost-of-living crisis so the government is taking action to make sure Australians are not paying more than they should for the things that they need.

“A major inquiry has been launched into allegations of price gouging and the competitiveness of retail prices in the supermarket sector, led by the powerful ACCC,” MP Hill said.

Low to middle-income households had felt more pressure from the cost-of-living crisis due to a lessened ability to accommodate for the rising prices of essential goods, such as food, healthcare and mortgage payments by going through their savings.

The redesign is aimed to ease that pressure, with the current margins aimed at higher-income earners.

“Labor is also adjusting the Medicare levy low-income thresholds so people in lower incomes pay less, or are exempt from, the Medicare levy helping more than one million Australians.

“Labor’s tax cuts build on the billions of dollars of targeted cost-of-living relief that is already being rolled out.

“This includes energy bill relief, cheaper medicines, strengthening Medicare, income support payment and the largest increase to Commonwealth Rent Assistance in more than 30 years,” MP Hill said.

Bracket creep is where one’s income growth causes that person to pay more tax each year but due to the effects of inflation the overall purchasing power is reduced.

So with lower tax rates under the redesign, people are taxed less and have more money to keep up with the rising cost-of-living.

Women will also see some large benefits from this change, since there are more women within the low to middle-income brackets as compared to the higher brackets.

The redesign expected to produce a much larger increase in labour supply which is driven by an increase in the hours worked and the general participation of women that have a taxable income between $20,000 and $75,000.

In total, labour supply will increase around 930,000 hours per week.

The Coalition has since backed the stage three tax cuts as of 6 February, with Opposition leader Peter Dutton announcing that his party would be making attempts at amending the bill but would not interfere if those amendments fail.

La Trobe MP Jason Wood echoed the same sentiment, stating that “the Coalition affirms its commitment to achieving lower, simpler and fairer taxes, exemplified by our support for reducing the 19 cent tax rate to 16 cents”.

However, MP Wood had placed great emphasis on Prime Minister Albanese going back on his word of not touching the Morrison stage three tax cuts before and after the last election.

“The Prime Minister’s lies and broken promises means that delivering the stage three tax reforms as they have been legislated is now impossible.

“The Coalition emphasises its dedication to combating bracket creep and fostering aspiration, and notes the importance of keeping promises even in challenging circumstances.”

For MP Wood, “the overarching assurance of the Coalition is a commitment to keeping promises as a cornerstone of responsible governance”.