By GEORGIA WESTGARTH

THE minute Sharon Stewart tells an insurance company she has made a claim “recently” her quote increases around $700.

Ms Stewart had her Ford Territory Turbo stolen from her “quiet” Narre Warren court on Sunday 1 May by a pack of young thieves.

Her children now jump at every sound they hear around their home, Ms Stewart told the News. As far as she’s concerned “Apex” or their copycat offenders have left her family $6,000 out of pocket.

“We had that car for 10 years, it was in perfect nick and had only done 130,000 kilometres – the payout we got wasn’t going to cover it, our car was rare,” Ms Stewart said.

The Stewarts replaced their Territory Turbo with another standard Ford Territory, but Ms Stewart says: “it’s not the same – I loved that car.”

As home invasions skyrocket around Casey and the state, Ms Stewart’s story is one echoed throughout the outer south-east region. Burglary and break and enters are up more than 38 per cent on last year.

And figures from insurance provider RACV also show a spike in claims for burglary.

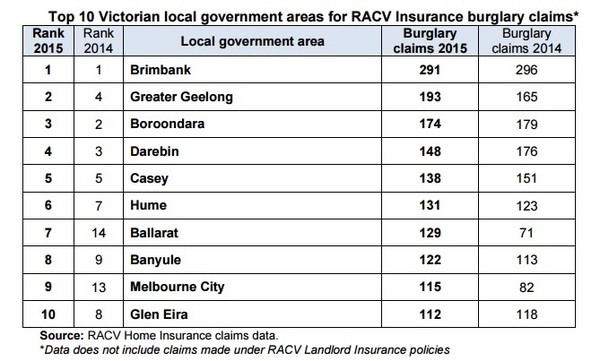

The City of Casey sits at number five in the top 10 local government areas to claim for burglary in 2014 and 2015.

Brimbank topped RACV’s list with 291 claims last year, while Casey residents claimed 138 times – down on 2014 with 151 claims made to RACV that year.

RACV Insurance Acting General Manager, Mark Geraghty said that overall there was a two per cent rise in the number of burglaries across the state, while the total cost of claims rose 12 per cent to more than $13 million.

Mr Geraghty said burglaries accounted for the third highest number of home insurance claims, after storms and water damage, and advised residents to exercise extra vigilance in the remaining winter months.

“Burglars are opportunistic and strike wherever they see vulnerability. Days are shorter in winter, so a break-in under cover of darkness could happen before you’re home from work,” he said.

Since the incident Ms Stewart has changed all the locks in her home and said the opportunistic crooks were going to continue to cost Victorians.

“It’s going to make a huge difference to all insurance policies, because they’re paying them out left, right and centre!” Ms Stewart said.

“It’s all going to cost everybody in the end but it’s also all the inconvenience and the time, but at least we’re all safe.”

Ms Stewart said it took more than three weeks until she was allowed to inspect her car.

“It was a mess,” she said.

“It was literally full of rubbish, choc-a-block full of junk, there was a petrol tank left inside with petrol inside it, people’s car registration service books and car manuals from five different cars and lots of pairs of sunglasses.”

Ms Stewart believes the thieves used her car as a dumping ground for all the items they had collected from other stolen cars.

Ms Stewart and her husband Gary were able to return one voucher of $300 found in their trashed car to its original owner.

“I called the company and used the reference number to get it back to the person who bought it,” she said.