By Alison Noonan

CASEY councillors have called for the State Government to scrap its recently announced $8000 infrastructure tax which they claim will make owning a new home unaffordable.

Councillors at last week’s council meeting said the development contribution would be a devastating blight on the city’s first home buyers and would affect residents in the Casey growth corridor more than any area in the state.

The new tax was announced by Premier Steve Bracks last month and will apply to 220,000 homes to be built on Melbourne’s fringe over the next 25 years.

The tax is set to be levied on developers but councillors fear it will be slugged onto home buyers and will force many people out of the market.

“I don’t know of any developers that will absorb that cost in a pink fit,” Strathard Ward councillor Lorraine Wreford said.

“This tax is quite likely going to add an extra $8000 to each property.

“It will disadvantage residents in our community more than any other. This is about liveability and affordability.

“We need to write to the State Government expressing our concern over a new tax that will burden our community,” she said.

Mayfield Ward councillor Steve Beardon said the council had a responsibility to keep its young people in the housing mix and out of rental properties.

“This tax can only be described as unfair,” he said.

“This is a tax on the very few that will make it impossible to move into home ownership.

“We should be helping people to get into homes and not taxing them out.”

River Gum Ward councillor Janet Halsall proposed that the council invite the relevant state ministers to visit Casey to view first hand the impact the tax would have on the city.

National development manager of Devine Homes John Gibson said the new tax would be tough on people buying land and homes in new estates.

“This will hit families hard as it will add thousands of dollars to their mortgages.

“It may mean the difference between people buying or staying renting,” he said.

Jon Wainwright, director of real estate agent Wilson Pride Century Cranbourne, said the tax could potentially bring prices up and slow real estate agents down.

“Ultimately it will affect everyone.

“We find a lot of the time people are dependent on price and that affects what they can afford,” he said.

Cranbourne MP Jude Perera said he believed developers would not pass the tax on to home buyers.

“Developer contributions are about ensuring developers who benefit from the release of land also contribute to the cost of infrastructure.

“With the Government’s changes to the Urban Growth Boundary, developers and landowners are to receive huge value increases when their land is brought into the new boundaries.

“In fact, independent data from property valuers Charter Keck Cramer shows in Casey-Cardinia, the median price per hectare for land can increase from $33,000 to $478,000 as a result of boundary changes,” he said.

He said the new Growth Areas Authority would act as a watchdog on housing affordability and continually monitor price movements.

“The authority will advise on the release of land to ensure competition keeps a downward pressure on prices,” Mr Perera said.

Call to scrap home tax

Digital Editions

-

Unlock your imagination

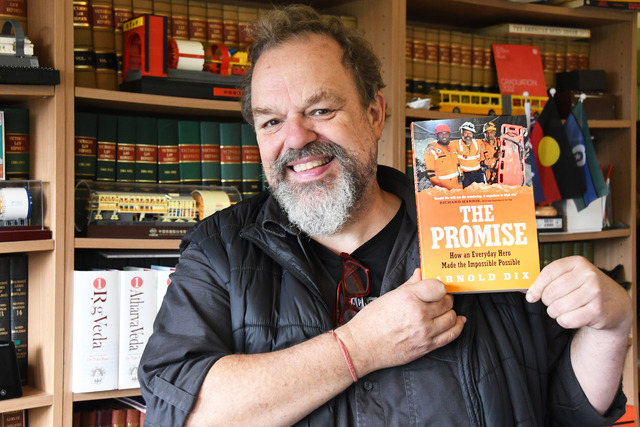

As Book Week celebrates the power of stories, local authors continue to inspire young minds, encouraging creativity, empathy, and the joy of reading. Gazette journalist…